Digital marketing is all about getting your message on the right channel, in front of the right people, and at the right time in the customer journey. If your efforts pay off, however, depends on how they stack up to your competitors.

Taking the first step

It all starts with competitive research and a comprehensive analysis of your current digital state. Before going to market, you need to identify your top three to five competitors – and we’re talking direct competitors here.

Then, the competitive research process begins and you’ll need to do a deep dive into five key areas:

- Website foundations and content,

- Social activity; paid and organic,

- Multi-channel content,

- Paid media efforts, and

- Audience targeting

Evaluating your website’s foundation

Do you know how your organization’s user experience (UX) design compares to others in your industry? Or, if your site’s user interface (UI) design is performing well with your target audience? From site navigation to blog content to SEO, a website’s foundation can make a lasting impact on your user.

If a website isn’t optimized or considered to be “healthy,” that’s likely the first place to start. Things like your website’s health score, number of pages, domain trustworthiness and mobile-friendliness can impact crawlability and indexability.

“Websites provide so much insight on you and your competitors. The hard part is determining what those insights mean in relation to your objectives, and then identifying which ones are the most valuable and actionable.” – Adam Sant, SSDM performance team

Your website’s foundation also includes the content and resources you’ve published. Here are a few questions to ask as you research competitors:

- Do they have resource hubs or educational help centers?

- How many blogs or content pieces do they publish each month?

- What are their main content pillars or frequently covered topics?

- Are their blogs engaging with clear calls-to-action? If not, this should be a priority for you!

Optimizing social media activity

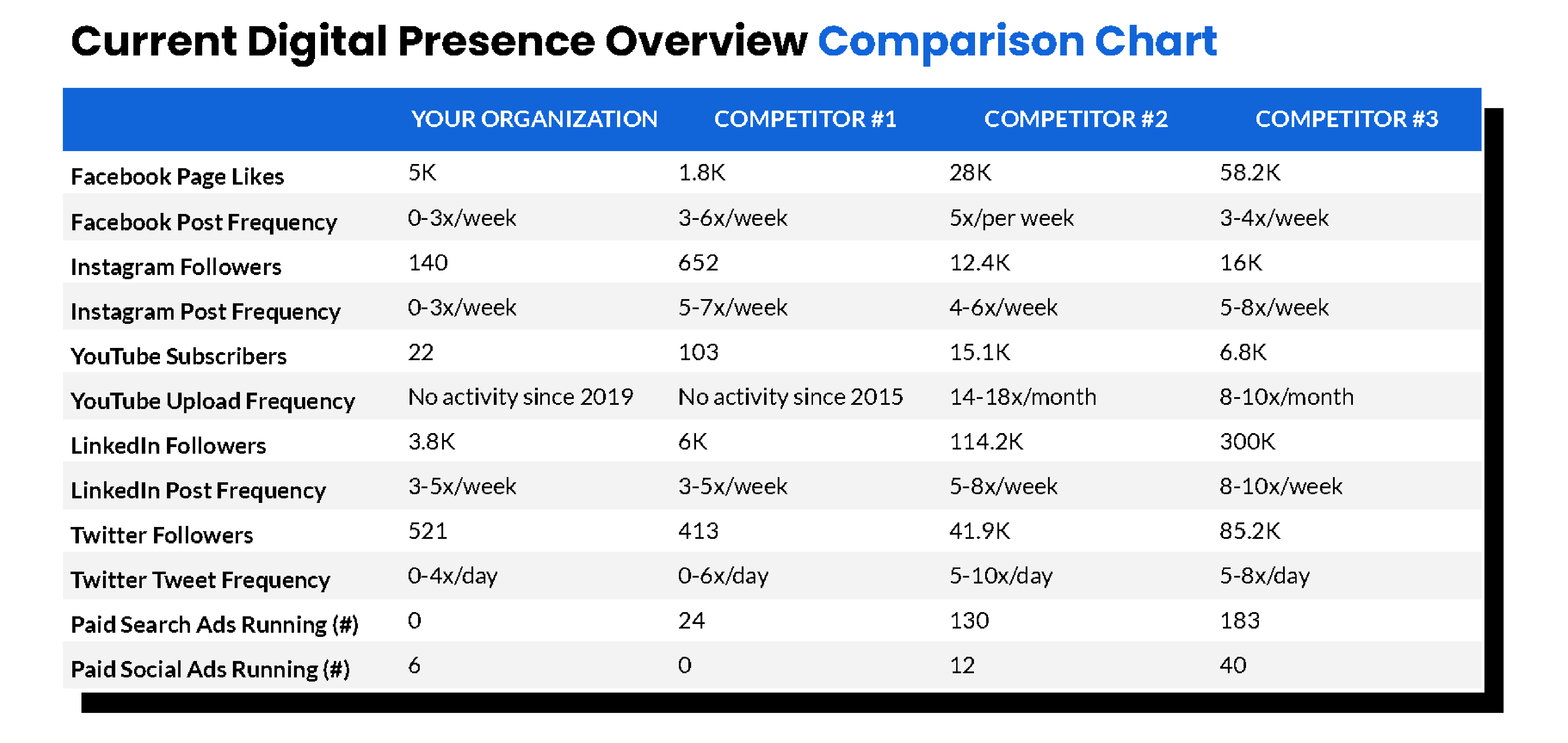

We’re in the age of social media and community management, so your digital presence can be a game-changer in the buyer’s journey. It’s easy to create a spreadsheet of follower counts and page likes but your research should go much deeper than that for each competitor.

- Social media platforms are they active on and how do they tailor their content? Remember that users engage with content differently across social media, so using the same copy or approach likely won’t work.

- What content are they posting? Are they focusing on recruitment efforts, sharing team culture photos, or creating educational content for their audience?

- Are the content topics, creative, and messaging consistent with their website? It can be confusing to your audience if your social media content appears to be completely disconnected.

- How frequently are they posting and what does the engagement look like? If they’re posting daily but seeing low engagement, a “less is more” approach could be a better strategy for you.

Yes, organic social is great, but your research should also include an analysis of your competitors’ paid social efforts. And the good news is that many of the same questions listed above can apply here. Once your research is complete, you should at least know the most common ad formats, the total number and frequency of ads, the monthly and/or annual ad spend and the platforms being used.

Developing a multi-channel content strategy

The lines are pretty blurry when it comes to which platforms are considered “social media” and which ones aren’t. For competitive research purposes, consider real-time, community-based platforms to be social media and everything else as part of your multi-channel strategy. This includes any YouTube channels, guest blogs, features on other websites, email campaigns and branded podcasts.

Now, this doesn’t mean you need to start filming videos or recording a podcast right away just because competitor #1 is doing it. The point is to gain visibility of your competitors’ digital presence and see just how successful – or unsuccessful – their efforts are.

Micaela Petrucci from the SSDM performance team shares her pro-tip: Look at your digital presence findings with a strategic mindset. It’ll help you piece together other areas of your competitive research (like audience targeting or paid media) to identify any underutilized platforms or gaps in content that you could help fill.

Investing in paid media efforts

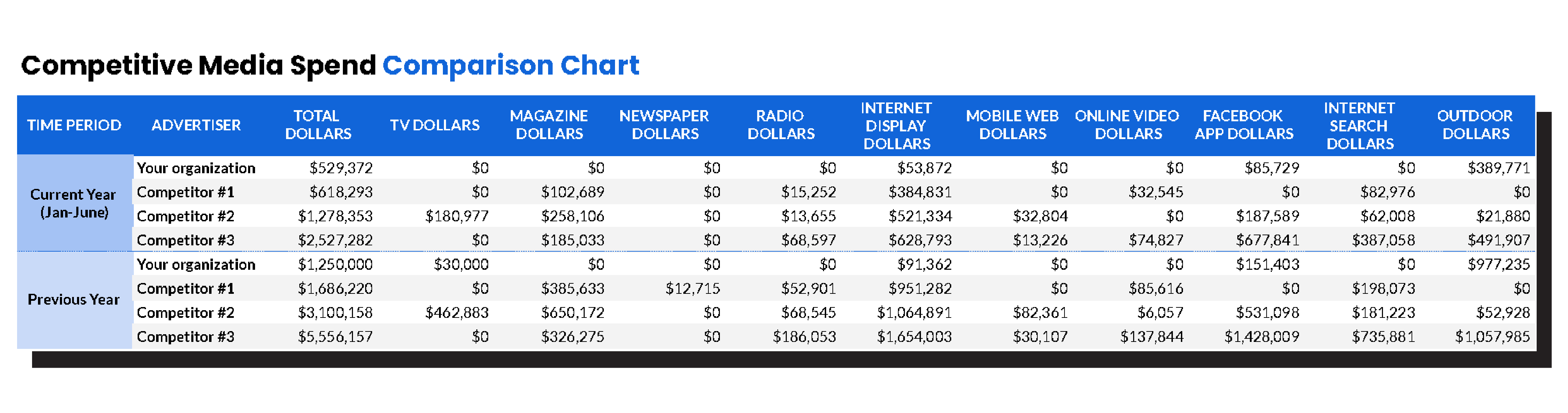

As companies forgo traditional advertising methods in favor of digital marketing and pay-per-click (PPC) advertising, it’s clear that paid media is a need, rather than a want. That’s why media spend is one of the most important components of competitive research. Identifying how much your competitors are spending on specific ad types and channels as well as their total media spend will help you do two things:

- Gain a clear understanding of what areas your competitors are or aren’t targeting – they might be wasting dollars on YouTube ads when your audience is actually more active on LinkedIn, and you can take advantage of that missed opportunity

- Determine monthly and annual budgets that are realistic and beneficial – a monthly budget of $100 for display ads won’t make much of a dent if your competitors are spending $10,000 on highly targeted multi-platform ads

Since most people are familiar with reading data from a spreadsheet, using comparison tables to relay your findings will help decision-makers better understand the organization’s digital marketing needs. And, it’ll serve as a quick reference sheet for future strategy or budget meetings. Here’s an example of a detailed paid media comparison chart:

Targeting your audience correctly

At this point, you’ve done some extensive research. None of the social media posts or careful website development matter, however, if you’re targeting the wrong people. This is a far too common challenge for organizations.

Think of it this way: You wouldn’t want to spend all of your time and budget serving up ads to your product’s end-user when there are three other decision-makers who need to approve the purchase and have very different criteria.

Evaluate the audience demographics and buyer personas that your competitors are trying to reach and, as always, compare those findings to your own audience targeting efforts. Then you can adjust settings, optimize messaging, test creative and repeat the process.